Probate Process Knowledge Base

As an inheritor, it’s completely normal to have many questions about the inheritance process. Many heirs are shocked to discover that this process, also known as probate, requires an enormous amount of time and money. That’s why we’ve answered some of the most frequently asked probate questions to get you in the know.

Read through our probate FAQ page to learn more about what to expect when settling an estate.

Want to skip the probate wait and get your inheritance now? Inheritance Funding provides cash advances to provide a portion of your inheritance within as little as 1 day, so you can use the money for funeral expenses or other uses without waiting for court proceedings to end.

Probate FAQ

In most cases, the decedent’s (person who passed away) worldly possessions will become their “estate” and will need to go through the Probate court process before distributing to the heirs.

Probate is the legal process where all assets and belongings of a deceased person are collected and distributed to the rightful heirs. The rightful heirs are identified using a valid will, if available. If there is no valid will, the estate will be distributed according to the intestate rules in the specific state. These rules prioritize all parties that could potentially receive money from the estate: creditors, family members, caretakers, etc.

The probate process covers all assets of the decedent, from bank accounts to real estate. During the court proceedings, money must also go to creditors or other debts before distribution to heirs.

Every state in the U.S. sets its own laws that control the probate courts within its borders. Additionally, some specific counties introduce additional regulations in their jurisdictions. Many states have enacted all or part of the Uniform Probate Code (UPC). That said, 33 of the 51 jurisdictions in the United States have not adopted the entire UPC.

The UPC and specific state guidelines standardize the legal process necessary to distribute money from an estate.

According to a comprehensive study of the Probate process done by AARP, the average time to distribute an estate in the United States is 17 months. Most heirs are extremely surprised that they won’t receive their rightful inheritance for a full year and a half.

In some cases, the inheritance process may take as little as six months to as much as two years or more.

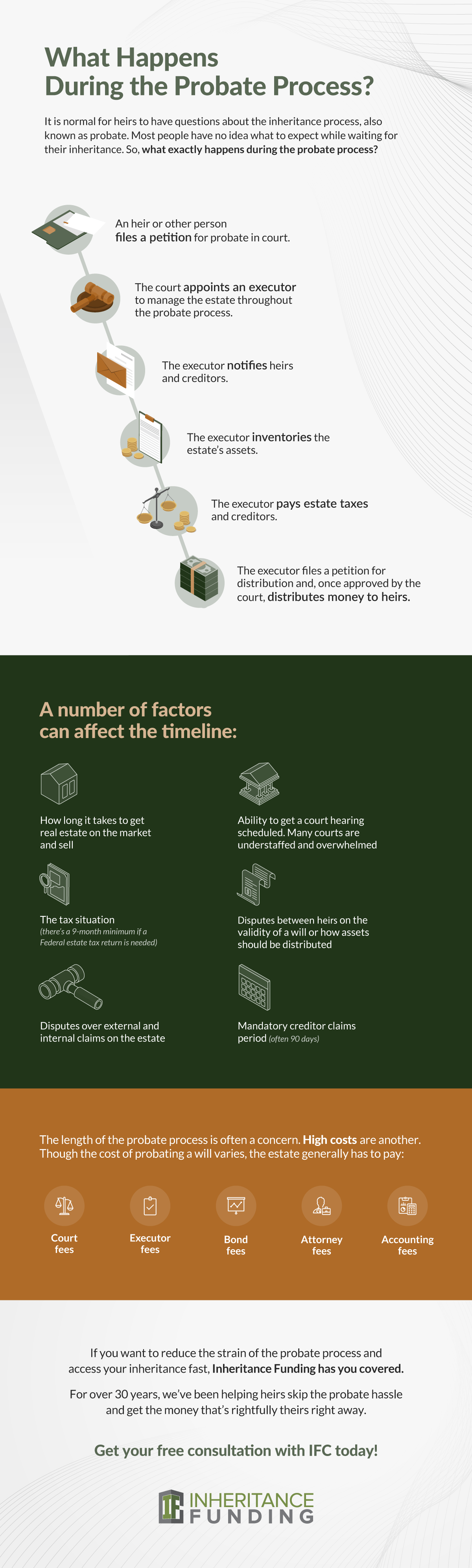

There are a number of factors that affect the probate timeline. Here are just a few:

- How long it takes to get real estate on the market and sell

- Complexity of the tax situation (for example, a nine-month minimum if a federal estate tax return is needed)

- Disputes between heirs on the validity of a will or how assets should be distributed

- Disputes over external and internal claims on the estate

- Types of assets in the estate (cash-only estates are much easier than estates with businesses or valuables that need to be appraised and sold)

- Mandatory creditor claims period (often 90 days)

- Efficiency of the personal representative and estate attorney working to close and distribute the estate

In general, the speed of probate depends on the complexity of the assets or distribution process, the amount of paperwork and the speed of the legal process. The courts prioritize proper legal proceedings over a speedy process, often creating a long wait.

You don’t have to wait! With an inheritance advance from IFC, you can access part of your rightful inheritance immediately. You choose how much of your inheritance you’d like to receive, and there are no restrictions on how you use your money. For more information, call our friendly staff right away to learn more: 1-855-683-4544.

Not all wills go through probate, but most do. Almost all states have rules in place where if the value of the estate is very small, you may be able to go through an easier probate process. In many cases, you can avoid the full delays of the inheritance process by using an affidavit procedure or summary probate for small estates — say, less than $75,000 in total assets, for example. Every state has different rules and limits. Be sure to check the state of your specific estate.

This question covers one of the most confusing aspects of the probate process for heirs. The estate attorney works with the personal representative (executor) only and only represents the estate itself. The estate attorney is not obligated to pass any information along to various heirs in the estate. This lack of information can be very frustrating for heirs who feel left in the dark about the state of affairs in the estate.

Heirs who are not executors might hire lawyers to represent them in certain cases. Probate lawyers help heirs contest the named executor or bring concerns about how the estate business is handled. Any heir who seeks representation can hire a probate lawyer to fight for their interests.

The person in charge of handling estate assets, usually the executor or personal representative, is responsible for filing tax returns and paying tax bills. Every state handles state inheritance and estate taxes differently, but a federal estate tax only applies to very large estates. In 2023, only estates larger than $12.92 million must pay federal estate taxes.

All tax payments and bills get sent out before the money is distributed to individual heirs, simplifying the taxation process. If the money is distributed before inheritance or estate taxes, an executor must return to the beneficiaries to get the taxation amount back.

Probate court is the part of the judicial system that addresses and distributes the property, assets and debts of the recently deceased through a process called probate.

These courts oversee all activities of the executor and ensure the will is executed according to the deceased’s wishes. The court ensures debts get paid, and assets are distributed according to the proper process. It also deals with situations like when a will gets contested.

During the probate process, the estate will accrue fees that cover the cost of passing on the estate, including:

- Surety bonds: These are written agreements to guarantee payment based on specific terms.

- Appraisal fees: You pay money to appraisers to estimate a property’s market value.

- Executor’s fees: These fees go to the personal representative appointed to manage the will.

- Court costs: This cost goes toward paying the court for any expenses of the legal process.

You may also have to pay legal and accounting fees for the attorneys and accountants assisting with your case. When the will is contested, these fees will rise.

Generally, probate costs range from 3% to 7% of the estate, but no hard and fast rule applies to every case. You could pay more if you have a drawn-out probate case, or you may pay less if the estate has fewer assets to cover.

Inheritance advance paperwork may include:

- The death certificate for the person whose will you are named in

- A copy of the legal will, if such a document is available

- A document from the estate executor or administrator explaining who they are and their relation to the estate

- A second document from the executor or administrator that outlines the amount you will inherit

- A confirming document that explains who was named the estate administrator or executor

Each inheritance advance company may have slightly different requirements, so check whether you’re eligible based on their requirements before you begin the advance process. One benefit of inheritance advances is that you do not need to submit income or credit score information, unlike you would with lending methods.

Probate is the legal process of distributing a person’s assets after their death, and it can take years to complete. The distribution includes paying heirs and taxes.

When a house is in probate, it goes through the legal process to distribute the property according to the deceased’s will. In most states, the courts must approve any real estate sale before the transaction is made. For example, if one heir wants to keep the property but the others want to sell it, the court will decide what happens to the property.

In most cases, you must go through probate to ensure money is allocated correctly. However, probate may be unnecessary in a few instances:

- Property held jointly: People often own property jointly with their spouses, siblings, children or other loved ones. In this case, the rules of survivorship apply — meaning the property automatically passes to the surviving owners — and probate is not required.

- Assets with designated beneficiaries: Assets from life insurance policies, retirement accounts and annuities pass to designated beneficiaries. They transfer automatically per the policy terms, so they do not become part of the probate estate.

- Small estates: Most states have an abbreviated probate process for small estates valued under a certain amount. This process involves less court supervision and fewer legal requirements.

- Revocable living trusts: Assets in a revocable living trust are not subject to probate. This arrangement allows the assets to pass to the beneficiaries per the trust agreement.

Specific probate processes vary from state to state, but in most cases, a few general steps apply:

- File a petition: An heir or another person designated in the will files a probate petition in court. This petition involves official acknowledgment for the executor and giving the court a valid will and death certificate.

- Get approval: During a hearing, the court appoints an executor to manage the estate during the probate process. The hearing also includes time to hear objections from other parties.

- Give notice: The executor notifies heirs and creditors. Notice may take the form of a letter or a newspaper announcement. This notice gives interested people a chance to act on the will, like changing the venue for probate.

- Inventory assets: The executor inventories the estate’s assets. These include bank accounts, stocks, real estate, retirement accounts and personal belongings. After a complete inventory, the executor presents an inventory to the court.

- Manage distribution: The executor pays estate taxes and creditors and distributes money to heirs. Once the distribution is finished, the estate is closed. All receipts and records are given to the court to finalize.

The cost of probating a will varies significantly depending on state law and the estate’s complexity. Generally speaking, the estate and heirs must pay several fees:

- Court fees: Filing the probate petition with the court typically costs a few hundred dollars. Additional court fees vary per state law, with costs ranging from a few hundred to more than a thousand dollars.

- Executor fees: The executor is responsible for managing the estate during probate, and they have the right to charge a fee for their services. How much they can charge is based on state law.

- Bond fees: Some states require a surety bond for protection against executor misconduct. The probate judge determines the bond amount before choosing the executor, and the estate typically pays the bond fee.

- Attorney fees: Hiring a probate attorney can cost several thousand dollars. The cost may be higher if the probate process or estate is especially challenging.

- Accounting fees: You must pay accounting fees to handle financial matters like filing and paying taxes. Accounting fees also depend on the asset type and the estate’s value.

Get Your Inheritance Fast at IFC

Inheritance Funding has all the probate advice you need to skip the process and get your inheritance fast. Since 1992, we’ve dedicated ourselves to helping heirs get the money that’s rightfully theirs without the hassle of probate. We offer a low price guarantee with no interest or risk of nonpayment, so you can feel confident and secure.

Get your free consultation with IFC today!