If you’re an heir to an estate, you may assume you’ll receive your share quickly. In reality, it can take as long as several years before the estate distributes your funds. The estate often must first go through probate — the legal process of distributing assets after a person’s death — before you get your inheritance.

So when will you receive your money? Learn about the factors that influence how long an estate is in probate to get a better idea of your timeline.

How Does Probate Work?

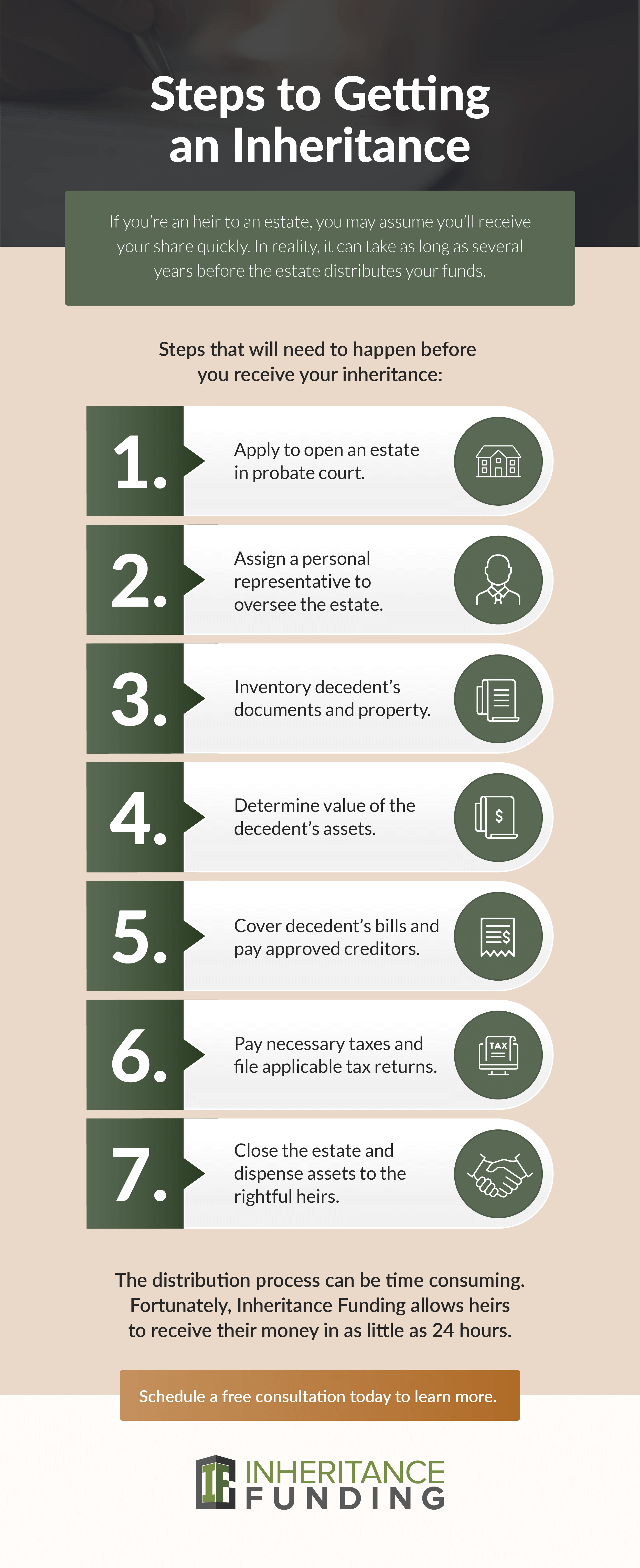

The specifics of the probate process vary across states, but a few general steps apply in most cases:

- An heir or someone designated in the will files a petition for probate in court.

- The court appoints an executor or personal representative to manage the estate during probate.

- The executor notifies creditors and heirs.

- The executor takes inventory of the estate’s assets.

- The executor pays creditors and estate taxes and distributes funds to heirs.

How Long Is Probate?

The probate process can take anywhere from several months to a couple years. Many factors affect the timeline, but major influencers include:

State Probate Laws

One of the primary reasons there is no definitive probate timeline is because the process isn’t nationally regulated. Instead, probate laws differ from state to state, with some states favoring more streamlined processes than others.

Estate Size

Generally speaking, the larger the estate, the longer it will spend in probate. Larger estates have more assets, which require more legal decisions, paperwork and other time-consuming tasks.

Conflict Between Heirs

Successfully closing the estate requires cooperation between the heirs. Disagreements can slow or halt the process.

Will Contest

A will contest is a legal proceeding initiated to invalidate a will. An heir may contest the descendant’s will if they believe:

- The will was improperly signed.

- The will was written under the influence of a beneficiary.

- There was fraud involved in creating the will.

- The descendant lacked the mental capacity to write the will.

Will contests typically involve lengthy court proceedings that can cause probate to remain open for a long time.

Debt and Taxes

The descendant’s debts and taxes must be paid as part of the probate process. Creditors must be formally notified of the estate, and they have a certain amount of time to file a claim, depending on state regulations. All creditor claims must be resolved before money can be distributed to heirs.

If the estate is taxable, an estate tax return must be submitted to the Internal Revenue Service (IRS). A taxable estate can’t be closed until it receives a closing letter from the IRS, which can take anywhere from six to eight months after submitting the tax return.

Request an Estate Advance From IFC

Many variables can impact the probate timeline and prevent you from getting your inheritance in a timely manner. At IFC, we help heirs access a portion of their share immediately. You can get a cash advance to use as you wish, with no collateral, interest or monthly payments involved. Schedule a free consultation with us to learn more.