Inheritance refers to the assets, property, debts and obligations that an individual assigns to a set of predetermined heirs who gain access to them after the original owner passes. When it comes to inheritance planning, there’s more to consider than meets the eye.

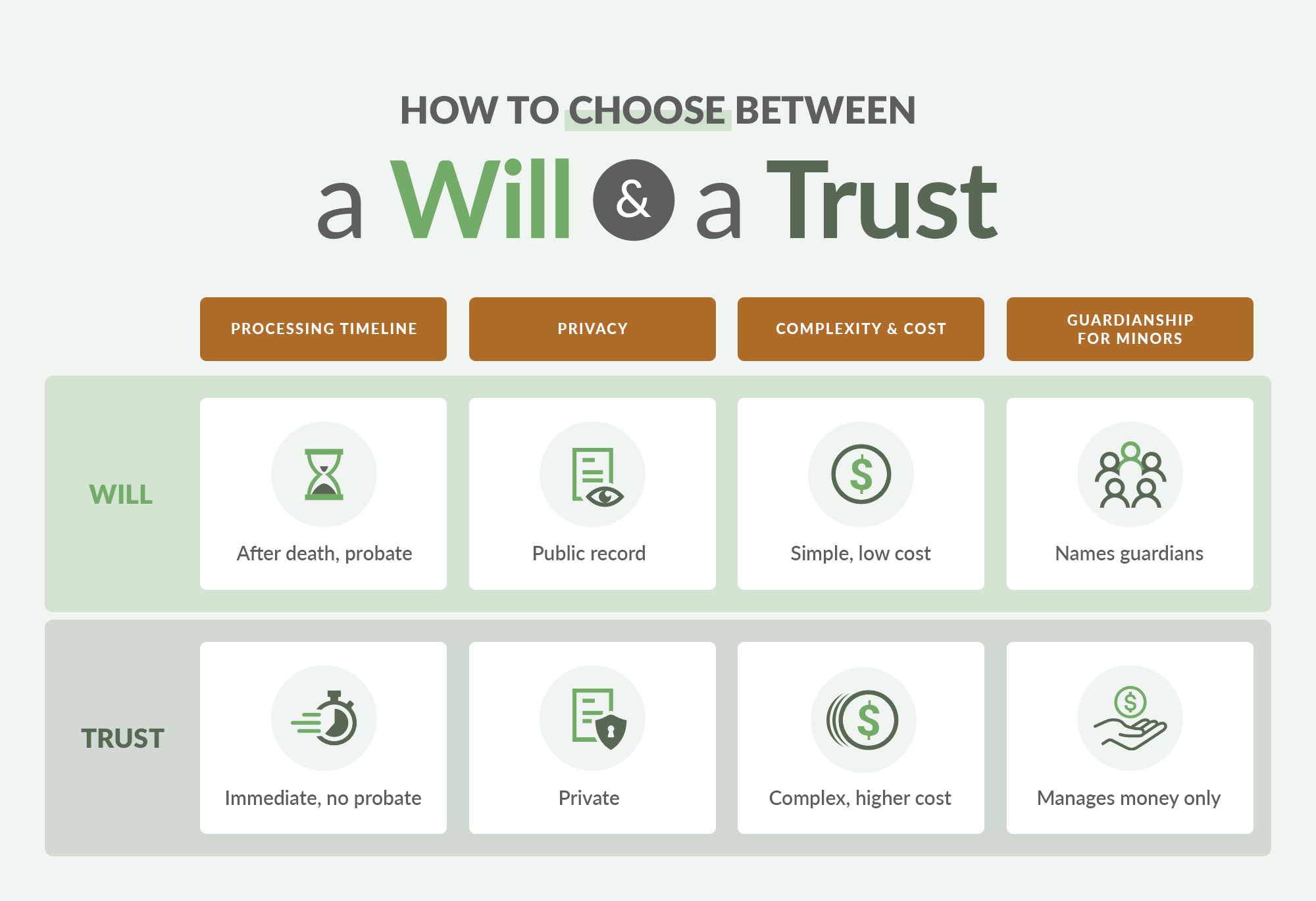

You can either create a will or a trust to allocate your assets when sanctioning off your estate. While the two solutions share a common goal of helping distribute your assets to your beneficiaries, they have core differences that impact the process.

Understanding the difference between wills and trusts is essential to leaving behind an inheritance — it allows you to choose one that serves the best interests of your beneficiaries. This guide from Inheritance Funding explores wills and trusts in detail to help you better understand your options.

What Is a Will?

A will is a document that explains what needs to happen to your properties (estate) and responsibilities after your passing. It comes into effect right after death and leaves instructions such as:

- Who receives your property or money: As the grantor or creator of the will, you’re required to name the beneficiaries of your estate.

- Who should take care of your children: If you have minors, you can also grant a specific individual parental guardianship over them.

- Who carries out the directions of the will: You can elect an executor of the will who will be in charge of carrying out your wishes, whether that is how your heirs get their inheritance or how your funeral is conducted.

While a will is a legally binding document, it must be created according to the individual state law and handled by a probate court, which oversees everything.

What Are the Different Types of Wills?

Since people’s lives and wishes vary, there are different types of wills that reflect their needs. Here are the main types of wills:

- Simple will: This is the standard will most people use, which highlights the executor, the guardian and beneficiaries. It’s straightforward and effective where the estate is not complicated.

- Testament trust will: This is a will designed to establish a trust that only starts after you die. It’s a will and a trust at the same time, and like all wills, it goes through probate and doesn’t activate the trust while you’re alive.

- Joint or mutual will: This is an irrevocable will generally made by two people, usually spouses. It outlines the wishes of both parties and comes into effect once one of them dies.

- Pour-over will: This type of will is meant to work alongside a living trust. It ensures anything that’s not already in your trust “pours over” into it automatically when you die.

- Living will: This will is very different from the others as it doesn’t provide instructions about your belongings. It only offers your wishes about medical treatment and end-of-life support in case you’ll be unable to voice your wishes at that time. It also only serves its purpose while you’re alive.

What Is a Trust?

A trust is an arrangement that comes with a legally binding document, which grants a third party the power to manage and distribute your assets on your behalf. Think of it like a secure container for your money or other assets that comes with a series of instructions on how they should be used.

As the settlor, you create a trust and put your money or property into it. Once that is done, the trust owns your assets, not the trustee who is the person or institution you choose to manage the assets. Also, your assets don’t automatically belong to your beneficiary, who is a person, people or an entity. The trustee takes from the trust and distributes to your beneficiaries according to the terms of the trust.

The settlor specifies the conditions of the trust, such as:

- Who receives what assets or benefits from the trust.

- When and how the assets will be distributed.

- Whether the trust will be dissolved after a specified time.

Since the trustee holds legal title to the trust property, they must hold and manage the property for the benefit of the beneficiaries. The settlor can also elect one or more trustees. In circumstances where there is more than one trustee, they are called co-trustees. It’s important for trusts to have more than one trustee to maintain oversight and ensure trust management is ongoing in case one trustee is unable to carry out their obligation.

Like wills, trusts are governed by state law, which vary. If you wish to create a trust, start by checking your respective state’s requirements.

What Are the Different Types of Trusts?

Like wills, there are various types of trusts. Their differences come down to factors like when they take effect or what purpose they are meant to accomplish. Here are some of the main types of trusts:

- Living trust: This is a trust set up while you’re alive. Once you fund it, it immediately takes effect and is managed according to your instructions. A living trust can be revocable or irrevocable, which affects your level of control over the assets.

- Revocable living trust: With this trust, you remain in control of your assets and can change, add or remove them. You can also cancel the trust at any time while you’re alive. However, since you control the trust, it usually doesn’t offer tax and asset protection benefits.

- Irrevocable living trust: Once you create an irrevocable living trust, you can’t change or cancel it. The assets that go into this trust are not yours by law and will remain under the management of the trustee according to the terms of the trust. While the trade-off is loss of control and flexibility, assets in this trust can be protected from creditors, lawsuits and certain taxes.

- Testamentary trust: This is the direct opposite of a living trust and acts as a will-trust hybrid. You create it through your will, and it won’t come into effect until after your death. It’s useful for managing inheritance for beneficiaries via a trust instead of a will.

- Charitable trust: This trust is designed to channel assets to a charity. It takes effect right after it’s legally created and funded. You can establish it when you’re alive or establish it as a testamentary trust to activate after your death. A well-structured charitable trust can also offer tax advantages.

- Asset protection trust: This is often an irrevocable trust designed specifically to protect assets from financial risks such as creditor claims and lawsuits. Since rules vary by location, these trusts need to be well-structured with the guidance of a legal team.

The Costs Associated With Wills and Trusts

When it comes to the costs of trusts and wills, multiple factors affect how much money you spend. These include:

- Estate complexity: Is your estate straightforward? Do you have several properties, assets and business interests? Is your estate confined to one region or scattered across different countries? These questions highlight the work needed to set up your estate planning structure, and the more work it takes, the more it will cost.

- Attorney fees: The cost of involving an attorney varies widely depending on your location (rural or urban) and the complexity of the estate.

- Professional expenses: Aside from attorney charges, you’ll need professional assistance if you hire an individual or firm to act as trustee of your trust. You may also need the services of a tax professional to iron out taxes before your will is fully executed. These services add to the overall costs of setting up wills and trusts.

How Much Does It Cost to Create a Will?

While the cost of a will prepared by an attorney or a law firm varies nationwide, expect to pay an average of $940 to $1,500 for a flat fee. For attorneys who charge hourly fees, the lower end is $100 and the higher end is $400.

Basic will templates and online services can be very low-cost, but they expose you to the risk of errors that may cost your beneficiaries.

While the initial cost of a will is low, consider the hidden cost of probate, a mandatory court process. It involves legal fees, such as filings and appraisals, and when you include the unexpected expenses of the lengthy probate process, the overall cost adds up quickly.

How Much Does It Cost to Create a Trust?

The cost of creating a trust varies by state, city, attorney service plans and whether the estate type is basic or complex. Unlike a will, a trust is a complex legal arrangement that usually requires various bundled services from an attorney, which cost more up front.

Attorneys also tend to charge for additional services, such as adding new assets and transferring business ownership. Due to these various factors, the cost of a trust can range from a few hundred to thousands of dollars.

Differences Between a Will and a Trust

Here is an overview of the key differences between a will and a trust.

| Will | Trust | |

| Purpose | Directs how your assets should be distributed after death. | Manages and distributes your properties whether you’re alive or dead. |

| Best For | Simple estate and basic asset distribution, or specific wishes to be carried out after death. | Large or complex estates and long-term planning before and after death. |

| Distribution speed | Slower because the process must go through the probate court. | Faster because it bypasses the probate process. |

| Activation | Only takes effect after death. | Comes into effect once created and funded. |

| Costs | The cost varies due to several factors, but it is generally lower than that of a trust. | Costs more due to its complexity. Often, the setup and ongoing management are the primary drivers of cost. |

| tax planning | Limited. | More options for estate and tax planning. |

| Guardianship for Minors | Allows you to choose a guardian for children. | Focuses on assets and doesn’t address guardianship for minors. |

| Privacy | Must go through probate court, which is a public process. | Not subject to probate, offering more privacy for properties and beneficiaries. |

How Do Taxes Differ Between Wills and Trusts?

One of the key factors to keep in mind when building an estate plan is tax implication. Wills have little to no protection against taxes because distributed assets are part of the grantor’s taxable estate.

Trusts offer room to bypass estate taxes or cut down on the grantor’s and the beneficiaries’ tax burden. It all depends on the type of trust. Considering you would retain control over a revocable living trust, assets in that trust are included in your taxable estate. However, assets transferred to certain types of trusts, such as irrevocable and charitable trusts, offer tax benefits and deductions.

How to Choose Between a Will and a Trust

Choosing between a will and a trust is a major decision in estate planning, and the right choice depends on your financial situation and goals. Here are factors to help you decide:

Processing Timeline

The timeline for each process varies widely. Trusts can go into effect as soon as possible and start serving your beneficiaries, unless it’s a testamentary trust. Wills are only active after your death and will serve your beneficiaries after the court-supervised probate process, which can take anywhere from months to years.

Privacy

If privacy matters to you, consider setting up a trust. Since trusts avoid probate, details of your assets and beneficiaries remain private. Probate turns a will into a matter of public record, meaning anyone can access the proceedings and details of your estate.

Complexity and Costs

A simple will is generally less expensive and easier to create than a trust. It’s great if you have straightforward finances and family dynamics. Trusts are more complicated and expensive to set up initially. However, they are designed to serve complex estates. If you have multiple properties, business interests and beneficiaries who need guidance, a trust offers control and structure.

Guardianship for Minors

If you need to legally appoint someone to take care of your underage children in case you pass away, you need to voice your wishes in a will. It allows you to name a guardian and a backup guardian. A trust only holds and manages money for your children and controls how it’s used. In this case, you can choose to create both a will and a trust to ensure everything goes according to plan.

Final Thoughts

Trusts and wills have clear differences, but ultimately, both let you decide how to distribute assets to your beneficiaries and when. Remember, there’s no better solution between the two in every situation, as each addresses different challenges. In the end, the right choice for you depends on your assets, your family and your goals. Also, it doesn’t have to be an either-or situation. Some people find using both more convenient.