If your loved one has passed and you’re now waiting for your inheritance, you may be wondering how long it takes before you receive it. You could also be an appointed executor, and you want to know how long the whole estate settlement process takes. The average time depends on many factors.

Does the individual have unpaid debts or unfiled taxes? Is the asset list readily available, or will it require some searching and liquidating? Are there deadlines imposed by your state laws? In this article, Inheritance Funding dives deep into the requirements that can affect the timeline.

How Long Does It Take to Settle an Estate?

With a few assets and no debts left behind, an estate can be settled in only a few months — about six to 12 months is a good rule of thumb. However, larger, complicated assets with creditors filing a claim can make the whole distribution process last for several years.

If you’re an appointed executor, then you need to manage and distribute the assets responsibly and avoid delays. You should familiarize yourself with state laws in case they limit filing periods. Understanding how the probate process works can help explain which steps take time.

How the Probate Process Works

The executor is appointed by the testator, the person who wrote the will. They can be a friend, family member or professional, such as a lawyer or financial advisor. There can also be more than one executor, and executors can be beneficiaries themselves. If the decedent died without appointing one, the state will select an administrator to perform the same responsibilities. These persons can exercise their duties through the probate process, under the probate court’s supervision.

That said, even before probate starts, the executor should obtain the death certificate and notify family members and other relevant parties of the testator’s passing. Once probate starts, here’s what you can expect.

1. The Probate Court Determines the Legitimacy of the Will

The probate court identifies if the will is valid. A valid will is written in front of witnesses and contains the decedent’s signature, although specific requirements vary. State laws may also require witnesses to sign the will. If the will is signed in a different state, it’s considered an out-of-state will and generally follows the laws of the state where it was signed.

The executor will likely have access to the will. However, any individual can submit the will to the probate court. Some states specify the time frame for submitting the will. In Texas, for instance, you should submit the will within four years of your loved one’s passing. In Alaska, you should submit as soon as possible or within three years if you’re aiming for an informal probate. Formal probate means there will be more court oversight, which can lengthen the process.

Depending on the state, the will can be considered invalid past the designated period. If so, the court may treat the assets as if there were no will. States also have their provisions on how they will distribute assets without a will, but this process can take longer than if there were one.

A will can be legitimized if it has an attached self-proving affidavit. This affidavit is a sworn statement signed by the testator and the witnesses. That said, some states do not allow these affidavits. Legal challenges to a will, like family disagreements with asset distribution, can also extend the probate process.

2. The Executor Organizes and Evaluates the Assets

The probate court gives executors the authority to start managing and collecting the assets in the estate. You may be required to get professional appraisals, especially for assets like real estate or those with fluctuating market values. By appraising the assets, you can determine if they are enough to pay for the individual’s remaining debts and taxes. You can refer to the Internal Revenue Code when assessing an asset’s value.

States can set deadlines for the inventory, while some probate courts set deadlines on a case-by-case basis. As an executor, you can organize the asset list and its valuations on a worksheet, although check if your state has its own inventory form.

If the decedent owned multiple properties, businesses and investments, this can result in a longer probate process. It can also get challenging if you don’t know where all the assets are located, which is why it’s beneficial to ask for an asset list after the testator has written the will.

That said, some assets are payable or transferrable to beneficiaries directly upon death, and consequently not controlled by the will. IRAs and life insurance are two examples of these. So, if your inheritance is one of them, you won’t need to wait for probate to finish to receive it.

3. The Executor Pays the Remaining Debts and Taxes

The individual’s remaining debt impacts when assets can be distributed. Some states limit the period in which creditors, those to whom money is owed, can make a claim, which usually lasts a few months. For instance, in Ohio, creditors should make their claims within six months after the testator’s passing. In Utah, creditors have three months from receiving a notice from the executor.

Examples of debts may include hospital bills, credit card debts or mortgages that haven’t been paid off. If you’re the executor, you’ll have to pay for these debts through the estate. Additionally, there are tax laws to keep in mind. For instance, an estate tax return may be required for the following assets:

- Real estate

- Securities

- Insurance

- Trusts

- Annuities

- Businesses

If the decedent passed in 2025, you’re required to file an estate tax return if the value of the relevant assets exceeds $13,990,000. You’ll have to apply for an Employer Identification Number (EIN) for the estate to use for the tax returns, statements and other estate documents. You should also file the final income tax return of your loved one for the year that they have passed, including returns not filed in the previous years.

The IRS has three years from the due date or from when an income tax return was filed to charge for additional taxes. However, you may ask for a prompt assessment to reduce this period to 18 months. This is applicable for any tax return, except for estate tax returns. That said, if the decedent failed to report more than 25% of their gross income or has filed a false return, then the IRS may deny your request for prompt assessment.

If the assets don’t seem to be enough to pay the remaining debts, debts owed to the U.S. are generally the priority, which includes the federal income tax and estate income tax liabilities. As an executor, you can consider opening a bank account for the estate to effectively manage its finances and debt payments. You may be required to provide accounting documents to showcase the estate’s financial activity. You may also ask for the help of a probate attorney for guidance on which debt should take priority.

4. Beneficiaries Receive Their Rightful Inheritance

Once all of the debts and taxes have been paid, you can distribute the assets to their rightful heirs as an executor. If you are an heir and not an executor, this is the period when you can expect to receive your inheritance.

If your loved one has passed with an abundant amount of assets and it is certain that all debts and taxes can be paid, then you may receive your inheritance from the executor more quickly. However, the court may also need to approve the distribution plan for the assets.

The assets will be distributed based on what’s outlined in the will. If there is no will, it will be based on the state’s intestacy laws — state laws that determine who gets what of the assets. That said, the type of asset affects how long the process can take. Liquid assets, such as cash, are easier to distribute. Real estate and other nonliquid assets can take longer.

Additionally, if family members or beneficiaries contest the valuation of these assets, the probate court may need to intervene, delaying the whole process. Once an executor distributes the assets successfully, they can provide proof to the probate court and request that the court formally close the probate case.

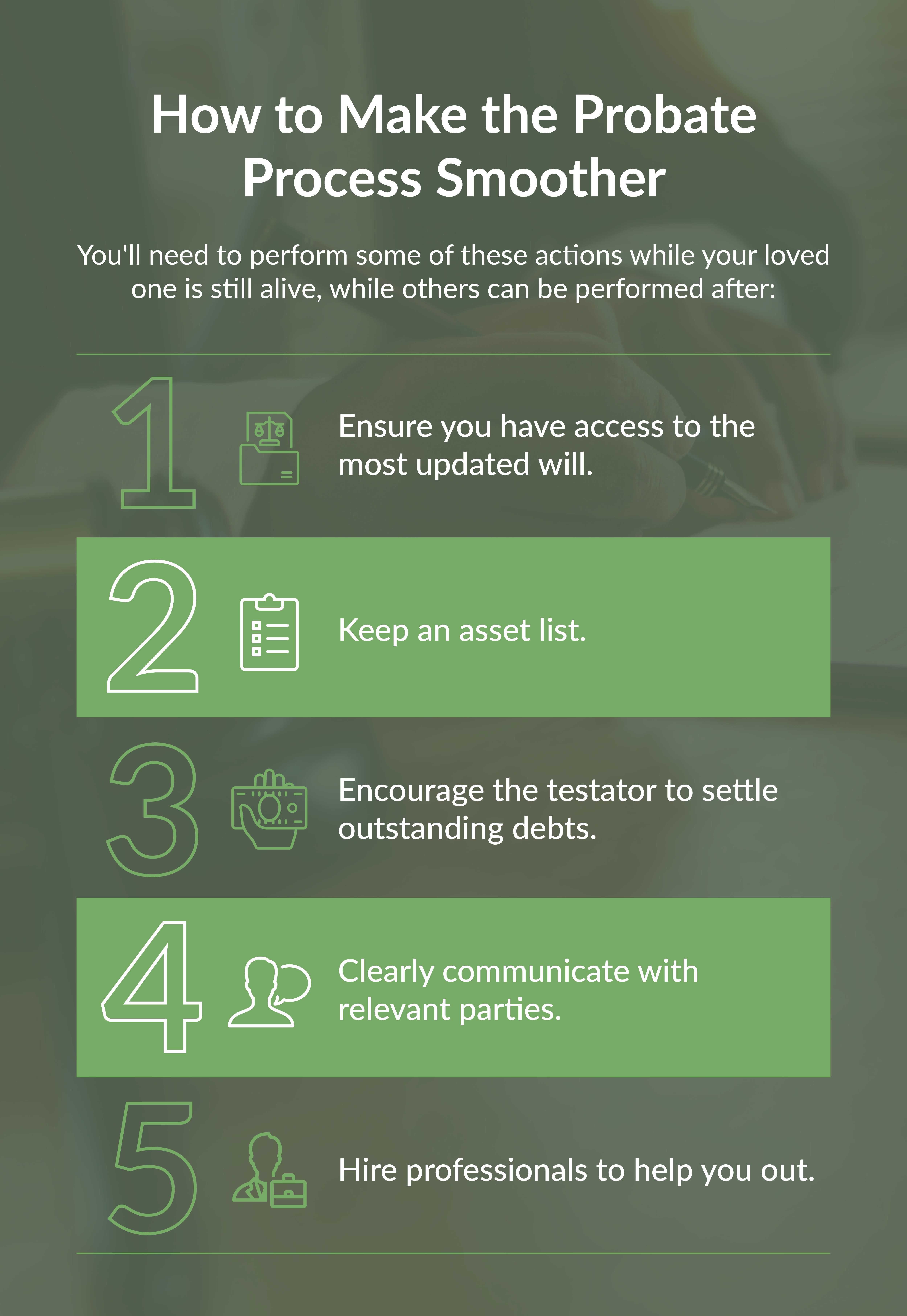

How to Make the Probate Process Smoother

Even though some of the causes of delays can be beyond your control, if you’re an executor, there are ways to help speed up the distribution of inheritance. You’ll need to perform some of these actions while your loved one is still alive, while others can be performed after:

- Ensure you have access to the most updated will: Multiple available wills can be confusing and delay the court in determining which is legitimate. If your loved one decides to update their will, the new will should be written in a way that revokes the old one, and the old one should be destroyed. Additionally, the will should be easily accessible without sacrificing its safety. Giving it to an attorney can help, as a will in a safe deposit box may still require court orders to be accessed.

- Keep an asset list: As an executor, you’ll want to be updated on the individual’s assets and where they are located. This will help you responsibly manage these assets and more accurately report their value. Missing or incomplete assets can delay the process.

- Encourage the testator to settle outstanding debts: Fewer outstanding debts equal fewer creditors that can make a claim. Accurate and timely paid tax returns can also help avoid personal liabilities.

- Clearly communicate with relevant parties: Effective communication can help reduce the likelihood of disputes, especially from emotionally distraught family members. They can report you if they believe that you’re failing to perform your duties. By keeping all relevant parties reasonably updated, you can protect yourself while managing the assets responsibly.

- Hire professionals to help you out: Whether it’s a certified public accountant (CPA) or a probate lawyer, you can ask professionals to help you in performing your duties. Because they will likely know more about probate than you, relying on their services can help speed up the process.

Frequently Asked Questions

To further understand how long it takes to receive or distribute assets, consider these common questions and answers.

How Is Inheritance Money Paid Out?

What you’ll receive as an heir depends on what’s written in the will. You may receive the inheritance money through checks, which executors can deliver through mail, or electronic funds transfer. Mail deliveries can provide a paper trail, which is essential for record-keeping. Electronic funds transfer can offer quick deliveries and benefit the heirs who live far away from the executor or the estate.

That said, some assets may require a separate process to distribute. For instance, if you’re inheriting a home, then you will have to go through the process of transferring the title to your name. Non-probate assets will be transferred directly to you, depending on the contract. For instance, if an asset is held in a living trust, it passes directly to you as the beneficiary named in the trust document.

Do Beneficiaries Have to Pay Taxes on Inheritance?

There are no inheritance tax requirements at the federal level, but your state may have some. In 2025, five states impose inheritance taxes, while 12 states have estate taxes. States with inheritance taxes include:

- Kentucky

- Maryland

- Nebraska

- New Jersey

- Pennsylvania

The states with estate taxes include:

- Connecticut

- Hawaii

- Illinois

- Maine

- Maryland

- Massachusetts

- Minnesota

- New York

- Oregon

- Rhode Island

- Vermont

- Washington

Keep in mind that estate taxes only apply once the value of the assets meets a certain threshold. Additionally, if your inherited property generates income, for instance, through interests, rental income, or dividends, then this income is taxable. Selling this property can also trigger capital gains tax if it has increased in value since the time of the decedent’s passing.

Why Would a Will Not Need to be Probated?

If your loved one has made an extensive estate plan or owns a small estate, the probate process can be bypassed. For instance, your loved one can set up joint ownership for real estate and bank accounts. They can also set up a transfer on death deed (TODD), where the deed to a specific property will automatically transfer to the heir upon the original owner’s death. The definition of a “small estate” depends on each state.

In Summary

The average time to settle an estate varies, but six to 12 months can be a good rule of thumb for estates with simpler assets. However, if the decedent has unpaid debts and taxes, then the probate process can last for years, as the estate would need to pay off each creditor. Additionally, while state filing periods can limit the timeline, disputes and missing assets will still lengthen the process.

Following best practices, such as keeping an accurate asset list, seeking the help of professionals and practicing clear communication, can help you more speedily distribute or receive your inheritance.