Personal representatives, such as executors and administrators, play a key role in avoiding probate delays. These people are responsible for managing the estate, which impacts the probate timeline. However, heirs and beneficiaries also contribute depending on whether they start disputes. A streamlined process and clear communication should help with these probate challenges.

To avoid delays, representatives must effectively navigate the steps involved in the probate process and the state requirements. State deadlines also control how long the process lasts. Whether you’re an heir, a beneficiary or a personal representative, you can take certain steps to speed up probate. Inheritance Funding discusses what you can do in this article.

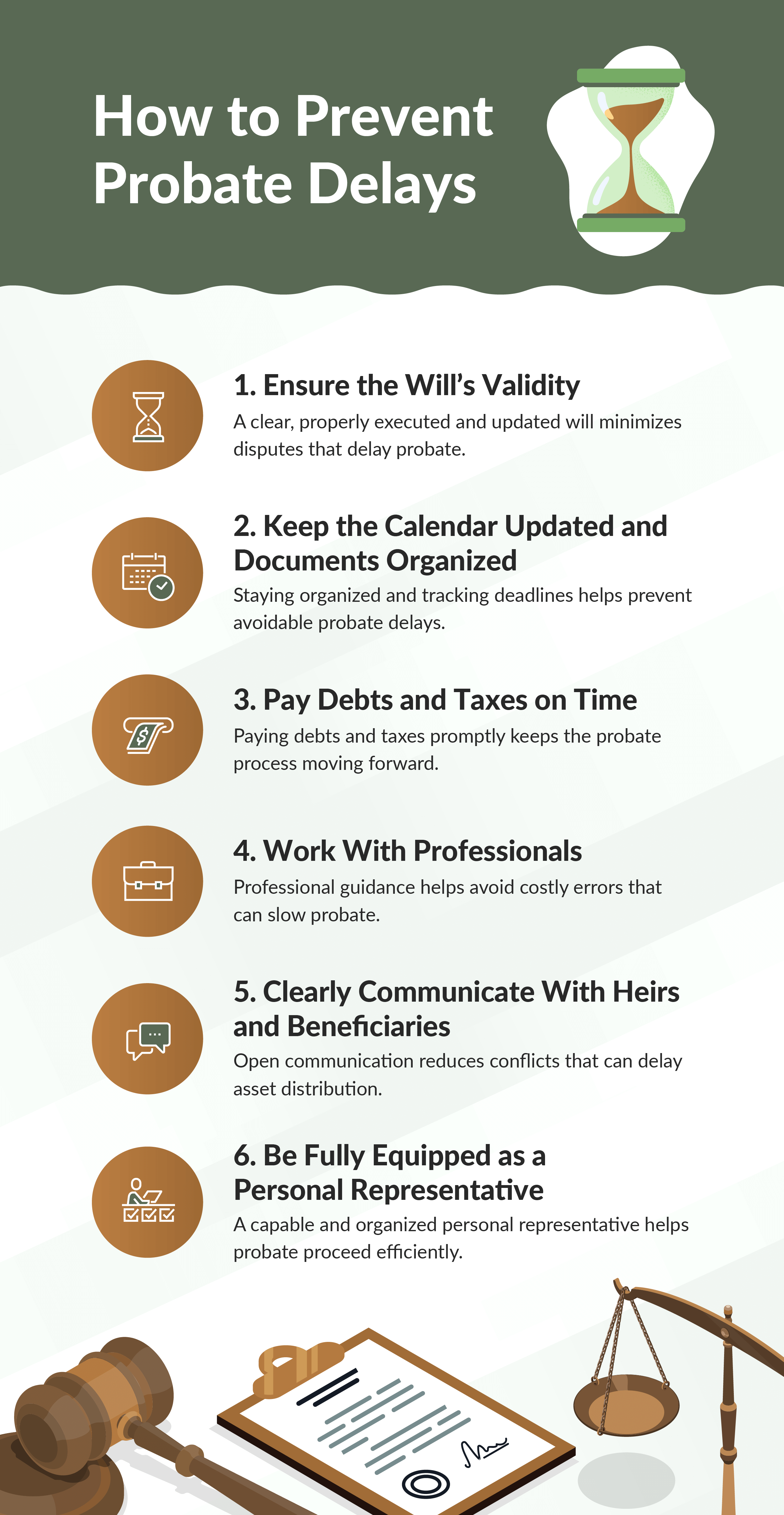

How to Prevent Probate Delays

Staying on top of deadlines and requirements is key to preventing probate delays. However, distributing assets takes time, whether or not there is a will. Without a will, state intestacy laws govern asset distribution. To reduce delays, personal representatives must:

1. Ensure the Will’s Validity

Executors are the personal representatives responsible for distributing assets according to a will. If you’re an executor, know that friends and family members may question a will’s validity due to:

- The will’s content: The will may have unclear, contradictory or outdated content. For instance, if your loved one has remarried and the new spouse is not in the will, family members may question if the will reflects your loved one’s true intentions.

- Your loved one’s signing capacity: When signing the will, family members may question whether your loved one was under undue influence or if they were a victim of fraud, where they thought they were signing a different document.

- Multiple wills: Your loved one creates multiple wills by updating the original without destroying the old one. Conflicting terms can lead to legal disputes.

You can reduce dispute delays by ensuring your loved one drafts a clear, valid will. State validity requirements vary, but estate planning attorneys can help. Typically, your loved one must sign and date the will in sound capacity. States may also require one to two witnesses to sign the will.

For handwritten wills, the probate court, which oversees the asset distribution, may need evidence of your loved one’s handwriting. Some states allow a self-proving affidavit to validate a will, which is a notarized, sworn statement signed by your loved one and their witnesses.

Your loved one should also regularly review and update the will, especially after major life events, such as marriage, divorce, birth or adoption. They may alter the will through a codicil, which modifies or revokes a part of the will. They may also update the entire will. However, your loved one should destroy the previous one to avoid multiple wills.

State laws limit the period for will challenges, which control delays. For instance, in Florida, beneficiaries have three months after you notify them of the probate case. Texas has a two-year deadline.

2. Keep the Calendar Updated and Documents Organized

Probate requires certain documents, such as:

- Original and copies of the death certificate

- Heirs’ and beneficiaries’ contact information

- Financial account statements

- Business agreement documents

- Deeds and titles

- Appraisal valuations

- Revocable living trust documents

- Tax records

- Loan agreements

- Life insurance policies

- List of medical and funeral expenses

States have deadlines for these requirements. If you’re a personal representative, know which deadlines apply to your case. For instance, if your loved one has properties in multiple states, you must take note of each state’s deadlines. Calendar alerts and spreadsheet trackers can help you stay on top of your schedule.

To keep documents organized, consider using physical binders and secure digital folders. Gathering these documents can take time, especially for larger estates. For instance, if you don’t have the property titles, you must consult with the relevant parties to access the requirements. Having records on hand can speed up court approvals.

3. Pay Debts and Taxes on Time

The estate pays for your loved one’s debts and taxes before you can distribute assets. Debt payments take time depending on asset liquidity — for instance, whether you must sell real estate to make payments — and how much your loved one owes. Past mistakes, such as incorrect tax returns, also delay the process. Deadlines for creditor claims and tax payments can help manage these delays.

For instance, in Florida, creditors must file claims within three months after newspapers publish your loved one’s passing. If they’ve received a direct notice, their deadline is within 30 days. However, to avoid debt payment delays entirely, you can encourage your loved one to pay off debts during estate planning. Other taxes to pay for may include:

- Federal estate tax: If your loved one’s estate exceeds the federal exemption amount, which is $13.99 million for 2025, then the estate must pay the federal estate tax. As a personal representative, you must file the tax return within nine months after your loved one’s passing.

- State estate tax: Some states charge estate tax, and requirements vary. For instance, in New York, the 2026 basic exclusion amount is $7.35 million. If covered, you must file the state estate tax return within nine months of your loved one’s passing.

- Income taxes: Income taxes include your loved one’s final income tax return and the estate income tax return, if the estate generates income during probate. For instance, the estate may be earning interest through bank accounts or stock dividends.

- Property taxes: Your loved one’s properties are subject to property taxes. This gets more complicated if properties are scattered across states. Each state has its own property tax laws.

- Generation-skipping transfer tax (GSTT): GSTT applies if your loved one passes property assets to grandchildren or close friends who are more than 37.5 years younger than them.

Paying taxes and filing accurate returns on time helps you avoid probate delays. Working with tax professionals, such as certified public accountants and financial advisors, can streamline the process. During estate planning, they can also strategize for reducing taxes. For instance, they may suggest setting up revocable trusts to reduce the size of the taxable estate.

4. Work With Professionals

Complex assets need professional appraisals. Appraisals take time depending on the asset type. Rare collectibles, fine art and antiques can be hard to value due to market fluctuations. Intellectual property, such as patents and copyrights, may also be tricky due to their uncertain future income streams.

While this delay type can be hard to avoid, it can prevent valuation mistakes that require correction. In Michigan, the list of inventory should include accurate asset values, and mistakes require supplementary appraisals.

If your loved one owned properties in multiple states, these properties require ancillary probates, causing further delay. Ancillary probates are secondary proceedings different from the original probate. These proceedings are necessary since states have different property laws. Working with professionals can prevent these issues during estate planning.

For instance, they may suggest setting up revocable trusts to exclude the properties from probate. If your loved one moves their properties into a trust, the trust becomes the owner of these properties. Since probate only impacts properties your loved one owns, the trust-owned properties don’t count. The rightful trust beneficiaries still get the properties, while everyone benefits from a shorter probate process.

5. Clearly Communicate With Heirs and Beneficiaries

Inheritance recipients without a will are called heirs, while a will names them as beneficiaries. Because of inheritance concerns, heirs and beneficiaries often engage in disputes. This can extensively delay the process and sometimes lead to litigation.

Apart from will challenges, heirs and beneficiaries may dispute whether you’re performing your duties as a personal representative. Mismanagement can cause delays, which impacts inheritances. For instance, mismanaged money can lead to using a part of an inheritance to pay for remaining debts and taxes. Probate courts may offer mediation programs to resolve these conflicts.

Mediators are neutral parties who facilitate the discussion. They have probate law expertise, are trained in mediation and have judicial experience. The goal is for everyone to achieve a voluntary settlement and avoid litigation. However, unsuccessful mediation moves the case to the probate court, where a judge conducts hearings before issuing a final decision.

Ideally, during estate planning, your loved one has communicated with all affected parties regarding what they can expect. However, you can also avoid disputes by regularly communicating with heirs and beneficiaries throughout the probate process.

Heirs and beneficiaries who relocate may be difficult to contact. This delay can be tricky to avoid for heirs. However, during estate planning, appointed executors can create a master list of beneficiaries, with their contact information. Your loved one can provide this information.

6. Be Fully Equipped as a Personal Representative

Unequipped personal representatives can significantly cause probate delays. For instance, disorganized executors can miss deadlines or prolong the documentation process. They may also have limited schedules if they have a full-time job, which slows down paperwork, tax filing and debt payments. To avoid these issues, being trustworthy, capable and reliable is essential. Soft skills, such as levelheadedness, also help when handling disputes.

Appointing multiple executors can solve scheduling issues, provided they can collaborate effectively. Sharing the work, especially for larger estates, can speed up the process. However, disagreements can exacerbate probate delays. If you’re appointed as an executor, consider asking for a secondary executor only if you can potentially be unavailable.

As an heir or beneficiary, you can report concerns regarding personal representatives — even if they are administrators appointed by the probate court. Although this dispute contributes to delays, it can improve the probate process if the representatives are lacking on their end.

How to Access Your Inheritance Early

Sometimes, life happens and you need financial assistance to cope. You know your inheritance is coming, but the probate timeline is uncertain. To avoid a stressful wait, consider the following methods:

- Inheritance advance: An inheritance cash advance lets you access a portion of your inheritance within as little as one day. In return, the service provider waits for probate to close and directly takes their pay from the estate, out of your share. The cost depends on different factors, such as the cash advance size, estate complexity and the amount of time until probate closes.

- Inheritance loan: Inheritance loans let you borrow money against your inheritance, where you use your inheritance as collateral. Lenders determine how much you can borrow depending on your inheritance. Your loan repayment comes with interest.

- Gifting: If you’re an appointed executor and your loved one is still in the process of estate planning, you can suggest gifting inheritances to offer family members and close friends financial support. Gifting also bypasses probate, potentially speeding up the process later on.

Frequently Asked Questions

Probate can be tricky to understand, whether you’re an heir, beneficiary or personal representative. To further explain how it works, below are answers to some common questions.

How Long Does Probate Typically Take?

Generally, probate can take nine months to several years to finish, depending on the size of the estate. Personal representatives must gather documents, provide notices to creditors, prepare the asset inventory, and pay outstanding debts and taxes before distributing the inheritance. A probate of simple assets in one state may close faster than a large estate with properties across the country. The number of disputes also impacts the timeline.

Is There Any Way to Speed up Probate?

Although delays can be hard to avoid, speeding up probate is possible with sufficient preparation. For instance, estate planning involves drafting a clear, valid will with the help of an attorney and setting up trusts that reduce estate size and taxes. It also involves appointing one or multiple executors who can perform probate responsibilities. Without an estate plan, asset administrators can speed up the process by keeping themselves organized.

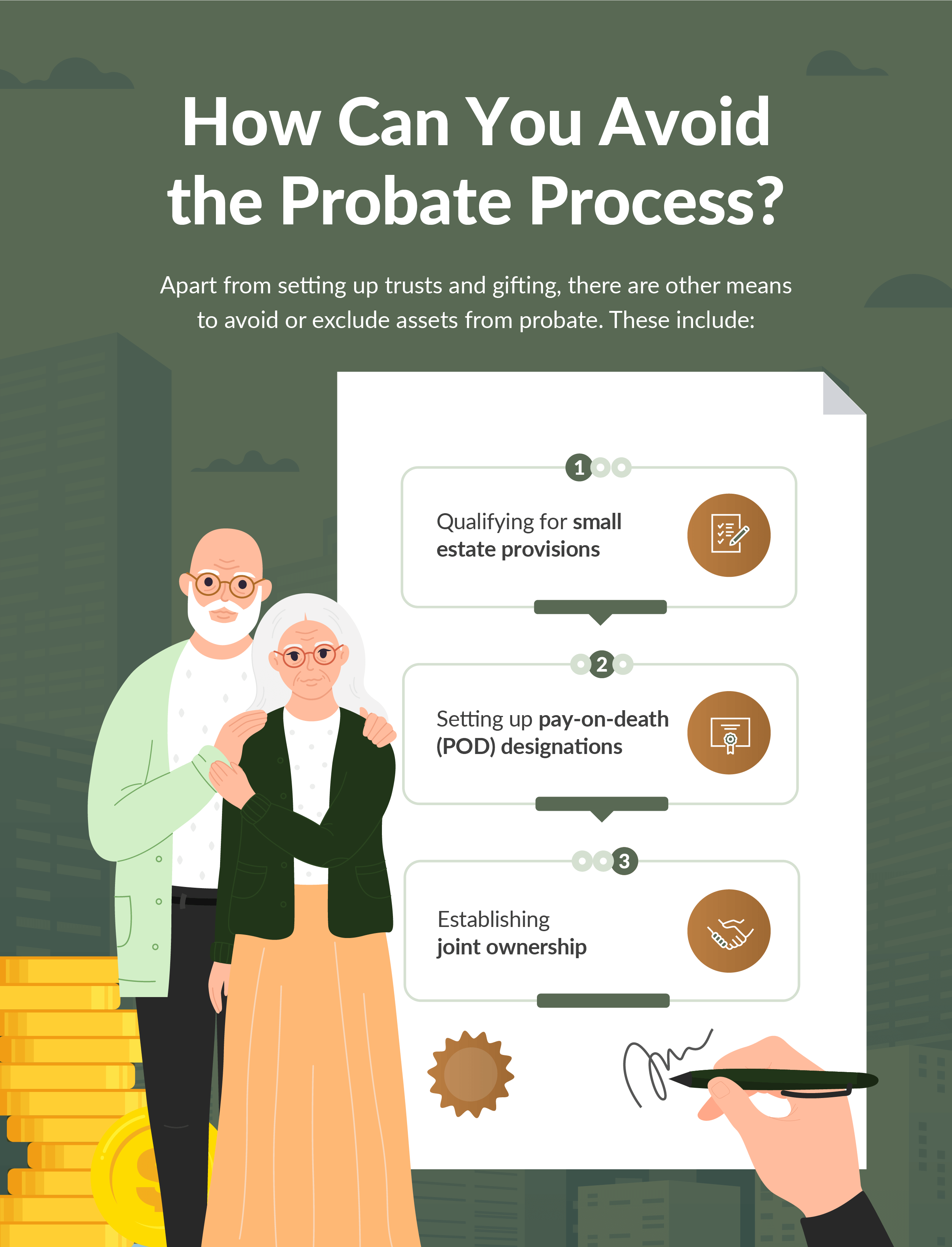

How Can You Avoid the Probate Process?

Apart from setting up trusts and gifting, there are other means to avoid or exclude assets from probate. These include:

- Qualifying for small estate provisions: Some states have small estate provisions that let you receive certain assets outside of probate. For instance, in California, if you’re inheriting personal property, such as stocks or bank account holdings, worth $184,500 or less, you won’t need the probate court to have them transferred to you. However, you must qualify for the other requirements.

- Setting up pay-on-death (POD) designations: PODs let you designate beneficiaries on financial accounts, such as a savings account. Upon your passing, the financial institution transfers the money to your beneficiaries.

- Establishing joint ownership: Joint ownership can apply to real estate, financial accounts, securities and other assets. With this ownership, the title passes automatically to the surviving owner.

Preparation Is Key to Avoiding Probate Delays

Knowing the common causes of probate delays and how to prevent them is essential in protecting your loved one’s assets and your inheritance. Probate delays may be hard to avoid. However, sufficient preparation can streamline the process and reduce disputes.

If you’re a personal representative, make sure you:

- Encourage your loved one to draft a clear and valid will.

- Stay on top of your schedule and organize the essential documents.

- Pay outstanding debts and taxes on time.

- Work with professionals whenever possible.

- Reasonably communicate with heirs and beneficiaries.

- Equip yourself with the right skills and knowledge to perform your responsibilities.

Although the bulk of the responsibility falls on you, heirs and beneficiaries also play a role. Effective collaboration is essential in speeding up the process.