When advancing an inheritance, companies offer heirs immediate access to their funds by buying a portion of their expected inheritance. It can take an average of 17 months to get your inheritance, which is a long time if you need cash now. This financial service serves as a solution if you need cash during the probate period.

The amount of an inheritance advance, though, depends on several factors. By understanding what influences this calculation, you will be well prepared to navigate the process and set realistic expectations. Learn how to determine the advance amount of an inheritance advance in this guide from Inheritance Funding.

What Is an Inheritance Advance?

An inheritance advance, also known as a probate advance, lets heirs access a portion of their expected inheritance through an inheritance advance company before the probate process wraps up. Unlike traditional loans, inheritance advances are non-recourse, meaning the heir is not personally liable if the estate lacks the funds to repay the advances.

Inheritance advances are structured as purchases of a portion of the heir’s future inheritance, not as loans. Key distinctions include:

- No monthly payments: Heirs are not required to make regular payments.

- No interest charges: Instead of accruing interest, the advance company receives a predetermined portion of the inheritance.

- No credit checks: Approval is based on the value of the inheritance, not the heir’s credit history.

- Non-recourse: If the estate’s value is insufficient, the heir is not obliged to repay the difference.

Here is how an inheritance advance works compared to other popular financial products:

| Feature | Inheritance Advance | Personal Loan | Payday Loan |

| Credit Check Required | No | Yes | Yes |

| Monthly Payments | No | Yes | Yes |

| Interest Charges | No | Yes | Yes |

| Collateral Required | No | Sometimes | No |

| Repayment Obligation | No obligation if the estate lacks funds | Yes | Yes |

| Approval Based On | Inheritance value | Creditworthiness | Income |

The Evaluation Process

When you apply for an inheritance advance, the company’s main goal is to confirm that you are legally entitled to a share of the estate and that the estate has enough assets to cover the advance. The process involves reviewing documentation, verifying your claim, and communicating with the estate’s representatives.

You will start by filling out an application with basic details about the estate, your relationship to the deceased, and your expected inheritance. Come prepared with these documents to speed up the evaluation process:

- A copy of the will

- The death certificate

- Probate court filings or letters testamentary

- Your government-issued ID

- Documentation of the estate assets

- Any communication from the probate court or executor about your inheritance

Inheritance advance companies typically work directly with the estate’s executor or attorney. Their goal is to ensure the estate is progressing through probate and that no legal disputes will affect your share. The approval process can take just a few days to a few weeks, depending on how quickly the documents come from the court or executor. Once verified, the company will evaluate the key factors to determine the advance amount.

Key Factors in Determining the Advance Amount

The amount of an inheritance advance depends on several key factors that help the company decide how much risk they are willing to take and how soon they are likely to be repaid. Inheritance advance companies offer a percentage of the estimated inheritance value, depending on:

- The estate’s size and complexity

- The state’s expected probate timeline

- Any existing debts or claims against the estate

- The company’s internal risk assessment

1. The Estimated Value of the Inheritance

The overall estate value plays a big role. Advance companies evaluate the estate’s assets, like property, bank accounts, and investments, before subtracting debts and expenses. Since probate laws and processes vary by state, timelines and estate valuation methods also differ, impacting how much risk a company takes on.

These transactions are typically structured as assignments of inheritance rights. While they do not fall under traditional lending laws, you should consult with a legal professional to fully understand the implications.

2. Number of Heirs and Claims

If you are one of several heirs, or if there are debts, liens, or disputes tied to the estate, the risk increases for the inheritance advance company. The more claims or potential conflicts, the more cautious they will be about the advance amount. More heirs also increase the chance of disputes among heirs over the will, asset distribution, or other issues that can trigger lawsuits. These potential delays make it riskier for the company, since they will not get repaid until the estate is settled.

3. State Probate Rules and Processing Time

Some states have longer, more complex probate processes, which can result in lower advance percentages, since companies need to wait longer for repayment and face more legal steps. A state with simpler probate laws may allow a higher advance amount because the company expects a faster, smoother process.

4. Legal Protections and Restrictions in the State

Some states have more restrictions on how inheritance rights can be assigned or sold. In these cases, companies may lower the advance amount or even avoid offering advances in that state due to higher legal or enforcement risks.

For example, if an heir expects $100,000 from an estate in California, probate may take 9 to 18 months. After evaluations, the heir’s estimated share sits at $90,000. The company may decide to offer an advance between $35,000 and $50,000, depending on how confident they are that the final estate distribution will cover their investment.

In a state with a simpler probate process, the same company may be willing to offer a higher advance, closer to that $90,000 estimate, because they expect fewer complications and delays.

Understanding the Fee Structure

Inheritance advance companies do not charge interest or traditional loan fees — they make money by keeping a portion of your inheritance as payment for giving you cash upfront. It is structured as a flat fee or a percentage of the inheritance amount. Put simply, the company buys a portion of your inheritance at a discount. When the estate is settled, they collect the full amount of that portion, keeping the difference as their profit.

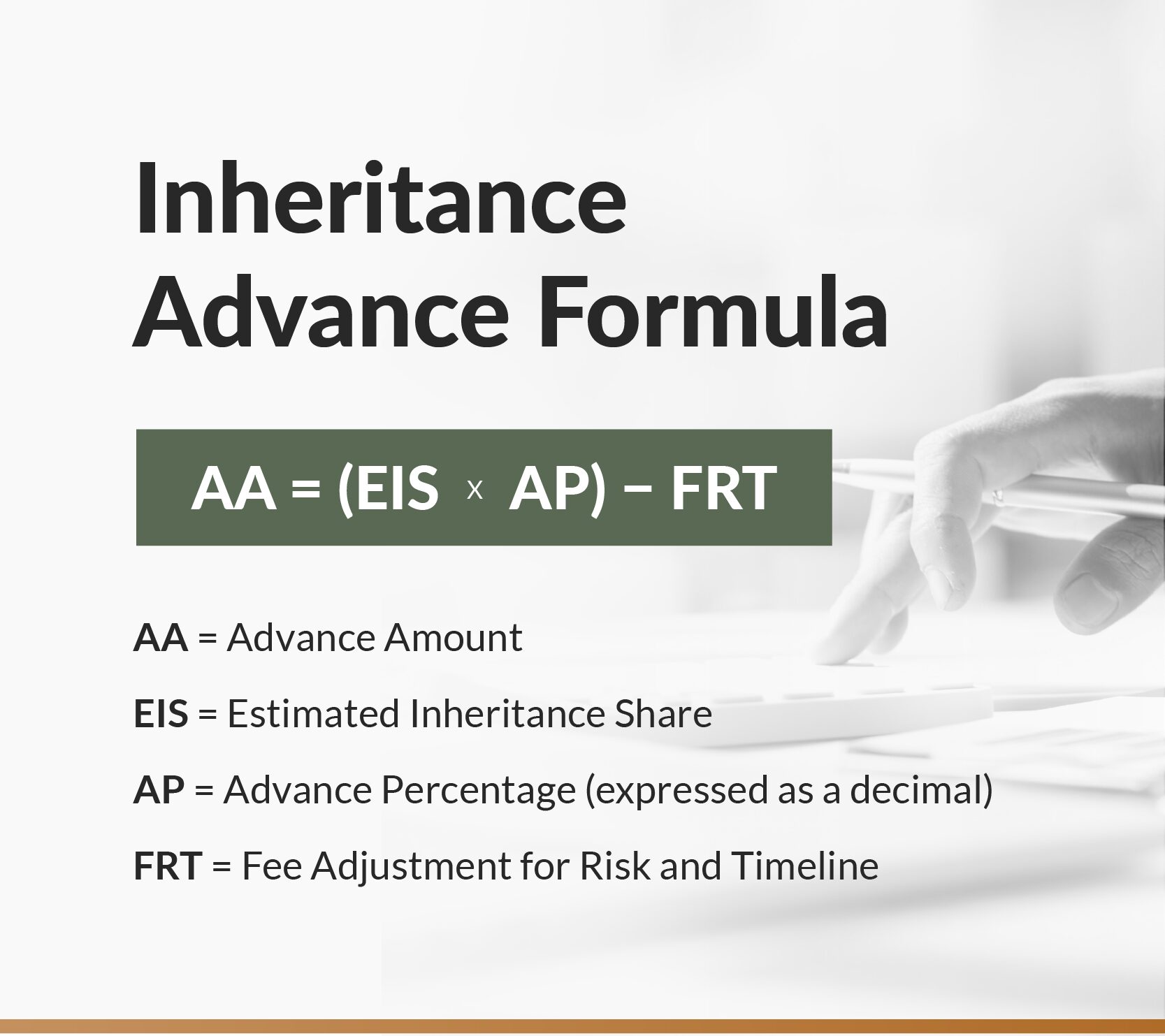

The fee is expressed as a percentage of the inheritance. Inheritance advance companies do not use a publicly shared, fixed formula like how banks use a loan calculator, but you can follow this basic formula:

Advance Amount = (Estimated Inheritance Share) x (Advance Percentage) – (Fee Adjustment for Risk and Timeline)

For example, if you are entitled to a $50,000 inheritance and the company offers you a $25,000 advance, they may collect $35,000 from the estate when it settles. The fee typically ranges from 10% to 50% of the inheritance, depending on different variables.

State and Jurisdictional Variations

While probate timelines vary by state, some states provide expedited probate for smaller estates, which can lead to quicker settlements. For example, in Arizona, estates with personal assets under $50,000 may bypass full probate. However, if the deceased owned real estate in another state, it can lead to additional proceedings and delays. In this case, you will require an ancillary probate.

Legal Developments Impacting Inheritance Advances

The adoption of the Uniform Partition of Heirs Property Act protects heirs from forced property sales. This Act is enacted in Florida, New York, Texas, and other states. It gives heirs stability, potentially influencing advanced evaluations positively. In 2024, the Supreme Court limited federal agencies’ regulatory authority, giving the courts more power to interpret statutes. This shift can lead to changes in how financial products, including advances, are regulated.

Frequently Asked Questions

Do you have further questions about how inheritance advances work? You are not alone. Here are answers to some of the most common questions heirs ask when considering an advance:

1. How Much Does an Inheritance Advance Cost?

The cost of an inheritance advance is generally a percentage of the total inheritance and is paid out of the inheritance itself. These fees can range from 10% to 50%.

2. How Does Risk and Timeline Affect Fee Percentages?

The fee percentage increases as the company’s risk or waiting time increases:

- Longer probate timelines: If the estate is expected to take 18 to 24 months to settle, the company will charge more because their money is tied up for longer.

- Higher risk: If the estate has debts, potential disputes, or unclear asset values, the company has a greater risk of not being repaid in full, so they charge a higher fee to offset that risk.

- Lower risk: If the estate is straightforward, with few heirs and clear assets, and it is already well into probate, the company may charge closer to the lower end of the fee spectrum.

3. Are Inheritance Advance Companies Regulated?

No, these companies are not heavily regulated like traditional lenders, but reputable firms will give you a written contract clearly stating the advance amount, repayment amount, and your cost. Ask for a written, itemized offer before you sign anything, look for reviews about the company’s fees, and confirm that the company charges a one-time flat fee that does not compound over time.

4. Can You Estimate Your Potential Inheritance Advance Yourself?

Yes, you can estimate your potential inheritance advance before starting the process officially to get an accurate offer. While the exact formula varies by company, the main factors you need are as follows:

- Know your estimated inheritance share: Start by figuring out how much you are likely to inherit, which depends on the estate value and the number of heirs. For example, if the estate is worth $300,000 and there are three equal heirs, your share may be about $100,000.

- Understand advanced percentage limits: The percentages depend on the estate’s complexity, risk, and timeline. For complicated estates, the number may be between 20% and 30%, while simple estates often look at 40% to 50%.

- Factor in the company’s fee: Remember, the company’s fee comes out of your inheritance, not your advance. If you expect $100,000 and the company offers you a $30,000 advance with a $45,000 repayment, their fee is $15,000. You still get the remaining $55,000 from the estate when it settles.

5. Is an Inheritance Advance Worth It?

Yes, if you need money fast and cannot or do not want to take out a loan, an advance against your inheritance may be worthwhile. Be sure to do research depending on what you need funds for — if you want to make home renovations, for example, a home equity loan may be a better choice.

6. Are There Non-Probate Assets?

Yes, specific assets can bypass the probate process despite being included in the taxable estate. For example, transfer-on-death property, trusts, and assets under contract are all excluded from probate. Non-probate assets pass directly to the named beneficiary and do not go through the probate court process. These can also include life insurance policies and retirement accounts.

However, note that inheritance advance companies typically do not provide advances on non-probate assets, as these assets are not controlled by the probate estate.

7. What Should You Look for in an Inheritance Advance Company?

When you are choosing a company for an inheritance advance, partner with one that is transparent, reputable, and responsive. Their contracts should be straightforward, they should put their terms in writing, answer your questions directly, and offer reviews from real clients.

Get Quick Access to Your Money With an Inheritance Advance

Inheritance advances offer a viable option for heirs who need quick access to funds without the obligations of traditional loans. However, it is essential to understand the terms and consult with legal professionals to ensure your choice aligns with your financial situation.

When you are considering an inheritance advance, familiarize yourself with your state’s probate process, assess the estate’s complexity and how this can delay your advance, and review legal protections that can affect your inheritance. By staying informed, you can better navigate the inheritance advance process and make decisions that align with your financial needs.