If you’re going through the probate process, you may hear terms like “heir” and “beneficiary” in conversations. Understanding these roles and their meanings will help guide you through the process and know what it means for you. Check out our guide to heir and beneficiary differences to understand these terms and why they’re important.

What Is an Heir?

An heir is someone with a relationship with the deceased. They typically inherit property or money from the person who has passed. When someone passes without a trust or will, their heir acquires their estate and belongings. Typically, an heir is a blood relative or a spouse, but there are a few different types of heirs. In most situations, the heir succession order will be spouse, children, descendants, close relatives and other family members. Parents can also be heirs if an adult child passes away before marrying or having children.

If multiple heirs have the same relationship with the deceased loved one, they will typically receive equal parts of the estate. For example, if a parent with two children passes, each child will receive 50% of the estate’s value, though they will likely receive different assets. These assets could involve vehicles, jewelry, cash, property, artworks, antiques, stocks, bonds and furniture.

Probate is the process of distributing assets when someone passes away and leaves their estate to one or more heirs. This inheritance administrative process can take years to complete, leaving heirs in probate waiting to obtain what is rightfully theirs.

Types of Heirs

Although the term “heir” is an umbrella term describing someone related to the person who has passed, there are a few different types of heirs. Each type has unique characteristics that you should understand through the probate process. The different types of heirs are:

- Heir apparent: The person most logically and likely to receive estate assets is the heir apparent. You cannot discount this person’s claim to the estate due to the birth of another heir. Essentially, the heir apparent is the person first in the order of succession.

- Presumptive heir: Unlike an heir apparent, presumptive heirs can lose their right to assets. Although they are entitled to their inheritance, another person can defeat or displace their right. Presumptive heirs typically inherit a throne or other hereditary honors, and these heirs are not typical for United States inheritances.

- Collateral heir: Collateral heirs share a bloodline with the deceased but are not direct descendants. For example, siblings, aunts, uncles and cousins would be collateral heirs.

- Adoptive heir: Often, adoptive heirs have the same rights as biological children. However, some states have implemented laws that can prevent adopted children from sharing an estate equally. Always understand your state’s laws to determine how this could affect you or your family members.

In the absence of a will or trust, heirs are the next of kin to the deceased. State law dictates the succession order, but a beneficiary can obtain assets even if there is no will to dictate this. For instance, if a married woman passes away without a will and has someone other than her spouse listed on an insurance policy, the proceeds would go to that person rather than the spouse.

What Is a Beneficiary?

A beneficiary is someone the deceased legally named to receive property from their estate. People will name beneficiaries in their wills to ensure they can give each family member or loved one the items, property or money they want. For example, a grandparent can name a grandchild the beneficiary of their property. Without this, the property would follow the succession order, and the grandchild’s parents would inherit the property instead. The grandchild would still be an heir, as they are related to the grandparent, but they would likely not inherit the assets the grandparent intended.

A will can name any person or people as the beneficiary for their assets, altering the succession order. For instance, if a parent has a strained relationship with a close family member, like a child, and does not wish for them to obtain assets, they can name another person to receive the asset and ensure it goes where they want to.

However, there is an exception for spousal rights. Spousal rights can affect the final asset breakdown if a single parent stipulates in their will that their children should equally share all assets but remarries without altering the will to include the spouse. Although they are not in the will, the surviving spouse can claim a percentage of assets.

What Is the Difference Between Heir and Beneficiary?

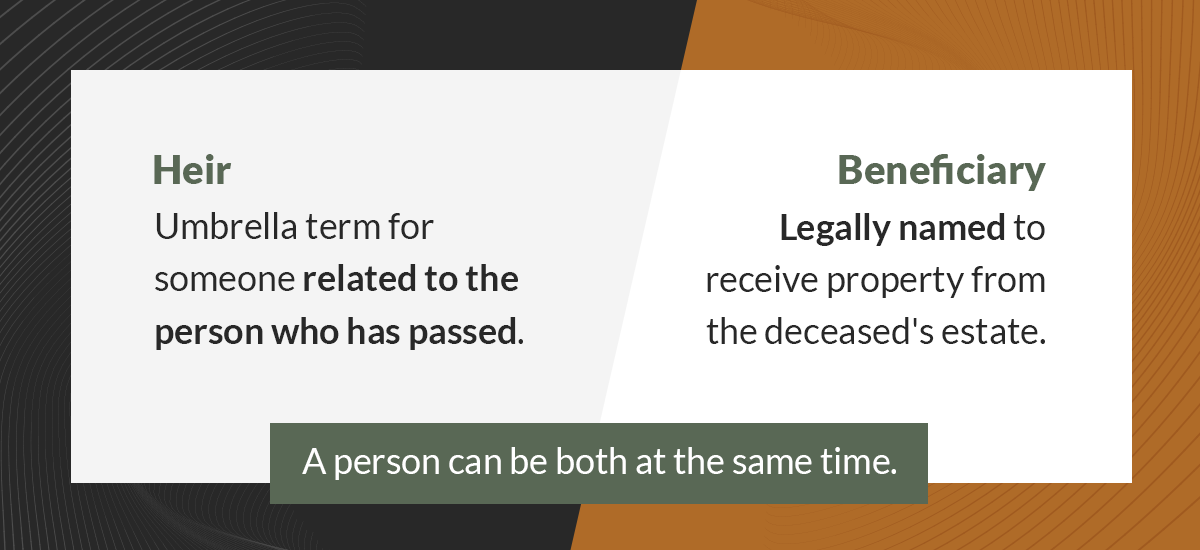

Heirs and beneficiaries share a similar role, but distinct differences exist. Because “heir” often refers to the person or people inheriting assets, many people commonly refer to those listed in a will as heirs. Although these people are technically beneficiaries, it’s common for these terms to appear in a similar context, especially because a person can be both at the same time. However, it is crucial to remember that not every beneficiary is an heir, and not every heir is a beneficiary.

Take this example: A parent has a strained relationship with their child and intentionally leaves the child out of their will. The parent instead decides to name a friend as the recipient of their home. In this case, the child is still an heir because of their relationship with the deceased, but they are not a beneficiary because the will clearly describes another person receiving the property. Additionally, the friend is not an heir because they are not directly related to the parent. Instead, the friend is a beneficiary.

Why Is It Important to Know the Difference?

Although these terms seem similar, anyone preparing an estate plan must understand these terms and what their differences mean for their surviving family members and loved ones. Without a will, the state decides who receives an estate’s assets and how they’re distributed.

If you’re creating an estate plan, you want to dictate clearly who will receive your assets. If a loved one has recently passed, understanding whether you are an heir, beneficiary or both can guide you through the probate process and help you understand what you may receive.

Get Your Inheritance Money Now With Inheritance Funding Company

Inheritance Funding Company offers fast and easy inheritance cash advances. We believe that inheriting money should be pain-free and quick. However, many people wait over a year to obtain what’s rightfully theirs. The inheritance process can contain many roadblocks and prevent you from getting the funds you need. That’s where we come in.

We’ve been serving the industry since 1922, and we’re the oldest and most trusted business you’ll find. We don’t require collateral, affect your credit or run employment or credit checks. We guarantee the lowest price, and you can expect your cash in as little as 24 hours, sometimes within the same day.

Get your inheritance cash advance today. We deal with the stress and complexity, so you don’t have to. Apply now in four simple steps. You’ll receive a no-obligation quote and be on your way to getting what’s rightfully yours much sooner.